Generative AI in Banking

Are you curious about how artificial intelligence is transforming the banking sector? Have you ever wondered how banks manage to handle an overwhelming amount of data on a daily basis? How machines could process the tedious and time-consuming tasks in banking, freeing up human resources to handle more complex matters?

These possibilities and more are within reach with the advent of generative AI in the banking sector. From retail banking to investment banking, the potential applications of generative AI are vast and promising. With its ability to create synthetic data and interpret non-numeric data, generative AI can streamline operations and enhance customer experience.

Join us on a journey to explore the top areas where generative AI can bring significant changes and unlock new opportunities in the banking sector. Let’s get started.

Key takeaways :

- Generative AI possesses the ability to process extensive historical data and use it to make intelligent decisions.

- The banking sector stands to benefit significantly from the implementation of Generative AI, particularly in areas such as fraud detection, risk management, and real-time decision making.

- Chatbots and Virtual Assistants powered by Generative AI are expected to play a vital role in the future of banking, providing enhanced customer support and personalized services.

Contents

What Are the Different Areas Where AI Has a Great Impact?

Generative AI revolutionizes the multiple domains within the banking industry. The top four areas where this technology could have the most significant impact are here. Let’s take a look.

- Retail Banking And Wealth Management: Large financial institutions handle an immense number of account openings each day, necessitating effective know-your-customer (KYC) processes that are efficient and reliable. With the help of generative AI, synthetic data can be created to train machine learning algorithms that power KYC. This technology can also be utilized to develop more precise natural language models for virtual assistants.

- Small And Medium Business (SMB) Banking: Generative AI can facilitate the interpretation of non-numeric data such as business plans, thereby augmenting the sophistication of virtual assistants. Additionally, generative AI can help analyze small business loan applications in a more accurate and efficient manner.

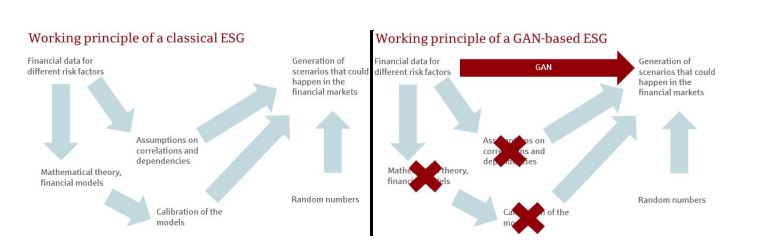

- Commercial Banking: The operations of commercial banking can benefit from generative AI, enabling faster completion of back-office tasks. By answering questions in real-time about a customer’s financial performance, even in complex scenarios, the technology can speed up operations. Furthermore, generative AI can supplement forecasting algorithms by supplying synthetic data in situations where limited data is available on business performance during specific economic conditions.

- Investment Banking and Capital Markets: It represents a domain where generative AI can contribute to the stress-testing of complex balance sheets containing illiquid financial products. By synthesizing test data from various scenarios, generative AI can improve the accuracy of financial stability measures and decrease compliance costs.

Hence, generative AI has the potential to revolutionize banking in a multitude of areas. Leveraging this technology can create more efficient and effective processes that will ultimately benefit their customers.

Also Checkout this post on Types of Generative AI Models

Use Cases of Generative AI in the Banking Sector

The banking sector has been quick to adopt generative AI technology, which offers a range of applications that can greatly benefit the banking industry. Here are the six most promising areas of application for generative AI in banking:

- Customer Service and Personalization – Generative AI can help banks provide more personalized customer service by analyzing data on customer behavior and preferences and generating recommendations for products and services that meet their needs.

- Risk Management and Credit Scoring – Generative AI can be used to analyze vast amounts of data to detect patterns that can help banks better manage risk and make more accurate credit-scoring decisions.

- Operation and Efficiency – Generative AI can help banks automate routine tasks and improve operational efficiency, allowing them to focus on more complex tasks that require human input and decision-making.

- Fraud Detection and Prevention – Generative AI can be used to identify patterns in customer behavior that may indicate fraudulent activity, allowing banks to take proactive measures to prevent fraud before it occurs.

- Investment Analysis and Portfolio Management – Generative AI can help banks analyze vast amounts of data on market trends and economic indicators, allowing them to make more informed investment decisions and manage portfolios more effectively.

- Chatbots and Virtual Assistants – Generative AI can be used to develop chatbots and virtual assistants that can provide customers with instant answers to their questions and help them navigate the banking system more easily.

Leveraging generative AI technology for banks can greatly improve their operations and provide better service to their customers, while also reducing the risk of fraud and making more informed investment decisions. The potential benefits of generative AI in banking are immense, and we are only beginning to scratch the surface of what this technology can offer.

Also read – Top 10 Generative AI Applications Use Cases & Examples

10 Generative AI Tools in Banking Sector

The banking sector has embraced Generative AI technology, and several powerful AI software development platforms have emerged that offer innovative solutions for various banking functions.

These 10 Generative AI tools have been specifically designed to cater to the banking sector’s needs, including automating customer service, generating synthetic data for KYC processes, and stress-testing complex financial products.

With these tools, banks can improve their efficiency, accuracy, and customer satisfaction while reducing operational costs.

1. DataRobot

DataRobot is an AI and machine learning platform that has gained significant traction in the banking sector. Its applications are diverse, ranging from credit risk modeling and fraud detection to customer analytics and personalization. One of the key benefits of DataRobot is that it democratizes access to AI and machine learning by providing a user-friendly interface that can be easily integrated into existing banking systems.

The platform enables banks to develop more accurate predictive models and make data-driven decisions with greater efficiency. By leveraging DataRobot, banks can improve their risk management practices, enhance customer experiences, and increase their bottom line.

Features –

- Democratizes access to AI

- User-friendly interface

- Easily integrates into existing systems

- Develops accurate predictive models

- Improves risk management practices

- Enhances customer experiences

- Increases efficiency and productivity

- Drives data-driven decision-making

2. H2O.ai

H2O.ai, a leading provider of AI and machine learning technologies, has emerged as a game-changer in the banking industry. With its cutting-edge AI platform, H2O.ai has enabled banks to leverage data-driven insights to enhance their decision-making processes.

The platform’s advanced algorithms can help banks improve customer experiences, detect fraud and money laundering, and optimize risk management strategies. Additionally, H2O.ai’s flexible architecture can easily integrate with existing banking systems, making it an attractive option for financial institutions looking to harness the power of AI.

By utilizing H2O.ai’s AI platform, banks can drive innovation and stay ahead of the curve in an increasingly competitive industry.

Features:

- Data-driven insights

- Flexible architecture

- Fraud detection capabilities

- Risk management optimization

- Easy system integration

- Improved customer experiences

- Cutting-edge machine learning technology

- Competitive industry advantage.

3. KAI

Banking KAI, or Knowledge Artificial Intelligence, is a cutting-edge technology that is gaining traction in the banking sector. This type of AI is designed to utilize complex data models and natural language processing to understand and respond to customer inquiries in real-time.

Incorporating Banking KAI into banks’ operations can get a more personalized and efficient customer experience. The technology can also assist in fraud detection and prevention, risk management, and compliance monitoring. As more and more banks adopt this innovative technology, the potential for increased efficiency and profitability continues to grow.

Features:

- Personalized customer experiences

- Enhanced fraud detection

- Improved risk management

- Automated customer support

- Advanced data analytics

- Predictive modeling capabilities

- Streamlined onboarding processes

- Real-time decision-making

- 24/7 accessibility

4. Symphony AyasdiAI

Symphony AyasdiAI is a cutting-edge AI solution that is revolutionizing the banking sector. This technology leverages the power of machine learning to help banks discover new opportunities, mitigate risks, and streamline operations. Symphony AyasdiAI can analyze vast amounts of data in real-time, allowing banks to make data-driven decisions quickly and accurately.

It helps in identifying patterns and trends that would be difficult or impossible for humans to detect, which can uncover hidden insights and make informed decisions that can drive growth and improve customer experiences. Overall, Symphony AyasdiAI is transforming the way banks operate and opening up new possibilities for the future of banking.

Features:

- Real-time data analysis

- Machine learning capabilities

- Risk mitigation

- Operational streamlining

- Pattern and trend identification

- Hidden insight discovery

- Data-driven decision making

- Enhanced customer experience

- Future-oriented technology

5. Numenta

Numenta is a cutting-edge AI technology firm that has made significant contributions to the banking sector. Their technology focuses on creating intelligent machines that can learn and understand patterns in data, similar to how the human brain functions. In the banking sector, this technology has been applied to fraud detection and prevention, risk management, and compliance monitoring.

By analyzing large volumes of data in real-time, Numenta’s technology can identify patterns and anomalies that might indicate fraudulent activity or non-compliance with regulations. The technology is also capable of identifying trends in customer behavior, which can help banks develop personalized offers and services. Overall, Numenta’s technology has the potential to revolutionize the way banks operate and deliver value to their customers.

Features:

- Hierarchical Temporal Memory

- Pattern recognition

- Online learning

- Anomaly detection

- Continuous intelligence

6. Personetics

Personetics is a leading provider of AI-powered personalization and customer engagement solutions for the banking sector. The platform leverages advanced machine learning algorithms to analyze transaction data and provide personalized insights and recommendations to customers.

By utilizing Personetics, banks can improve customer engagement, drive revenue growth, and increase customer retention. The technology is particularly valuable for digital banking channels, where customers expect personalized and seamless experiences.

Features:

- Personalized financial guidance

- Predictive analytics

- Automated financial insights

- Conversational AI

- Customizable interface

- Real-time financial notifications

- Goal-based financial planning

- Behavioral insights

- Integration with existing systems

7. Kount

Kount is a leading provider of fraud detection and prevention solutions for the banking sector. The company’s technology utilizes artificial intelligence and machine learning to analyze vast amounts of data in real time and identify patterns that could indicate fraudulent activity.

Kount’s solutions can mitigate bank risks associated with payment fraud, account takeover, and other forms of financial crime. Additionally, Kount’s technology provides a seamless and secure experience for customers, enhancing trust and satisfaction. Overall, Kount’s innovative solutions play a crucial role in ensuring the safety and security of financial transactions in the banking sector.

Features:

- Real-time fraud detection

- Machine learning-based analysis

- Payment fraud mitigation

- Account takeover prevention

- Secure and seamless customer experience

- Multichannel protection

- Risk assessment and scoring

- Compliance with regulatory standards

- Actionable insights and reporting

8. ZestAI

ZestAI is a cutting-edge generative AI tool that has been gaining traction in the banking sector. With its ability to generate synthetic data, ZestAI can help banks streamline their operations, particularly in areas such as know-your-customer (KYC) and anti-money laundering (AML) compliance.

The technology can also be utilized to develop more accurate and sophisticated forecasting models, enabling banks to make data-driven decisions with greater confidence.

Additionally, ZestAI’s ability to analyze unstructured data can prove useful in the interpretation of loan applications and other financial documents. As such, the integration of ZestAI in the banking sector holds significant potential to increase operational efficiency and enhance decision-making capabilities.

Features:

- Predictive Analytics

- Machine Learning Models

- Data-Driven Insights

- Automated Decision Making

- Risk Assessment

- Credit Scoring

- Fraud Detection

- Real-time Recommendations

- Explainable AI

9. IBM Watson

IBM Watson is a cognitive computing system that has found numerous applications in the banking sector. This technology can assist in various areas, such as customer service, fraud detection, and risk management. By analyzing vast amounts of data and identifying patterns,

Watson can enhance the accuracy and speed of decision-making. For instance, it can help banks identify unusual activity patterns in customer accounts, allowing them to detect and prevent fraudulent activity.

Additionally, Watson can assist in compliance management by analyzing and interpreting regulatory requirements. Overall, IBM Watson has the potential to transform the banking industry by improving the efficiency and effectiveness of various processes.

Features:

- Cognitive computing system

- Analyzes vast amounts of data

- Enhances decision-making

- Detects and prevents fraud

- Assists in compliance management

- Improves efficiency and effectiveness

- Identifies unusual activity patterns

- Interprets regulatory requirements

- Potential to transform the banking industry

10. ComplyAdvantage

ComplyAdvantage is a leading company that provides AI-powered solutions to address compliance and risk management challenges in the banking sector. By leveraging machine learning and natural language processing technologies, ComplyAdvantage helps financial institutions identify and mitigate potential risks related to money laundering, terrorism financing, and other financial crimes.

Their advanced solutions provide real-time monitoring of transactions and customer activities, enabling banks to stay compliant with regulations and protect themselves against financial crimes. ComplyAdvantage’s innovative technology has been widely adopted by the banking industry and has earned them numerous accolades, including being named to the Forbes Fintech 50 list for three consecutive years.

Features:

- Anti-money laundering (AML) screening

- Sanctions screening

- Politically exposed persons (PEP) screening

- Adverse media monitoring

- Real-time data updates

Quick Points to Remember When Opting for Generative AI Financial Services

Key steps to hire the best generative ai financial services include:

- Understand the purpose.

- Ensure data quality and privacy

- Choose the appropriate Generative AI Model

- Ensure regulatory compliance

- Maintain human oversight and interpretability.

- Monitor and update models regularly

- Seek transparency and explainability

- Manage risks effectively

- Test and validate before deployment

- Collaborate with Generative AI Financial Services

How Generative AI is Shaping the Banking & Financial Services?

Incorporating generative AI into banking operations requires strategic investments in infrastructure and personnel. Banks must prioritize the development of customized AI algorithms tailored to their specific needs. Additionally, hiring Machine learning developers and leveraging machine learning services will ensure effective oversight of this transformative technology. By focusing on these crucial aspects, banks can seamlessly integrate generative AI and unlock its full potential in the banking sector.

Generative AI tools have immense potential in the banking and finance industry. Are you ready to take your banking operations to the next level? Look no further than RedBlink, a generative AI development company who provide services tailored specifically for the banking sector.

In an era where technological advancements are reshaping the financial landscape, RedBlink stands out as a leader in harnessing the power of generative AI to drive innovation and efficiency in banking operations. If you’re looking for experienced ChatGPT developers in the field of generative AI in the banking and finance industry, RedBlink is here to assist you. Contact us today to explore how our team can help you harness the power of generative AI for your specific industry needs.

Contact us today to learn more about how to build a generative AI solution and prepare for the future of banking.

Director of Digital Marketing | NLP Entity SEO Specialist | Data Scientist | Growth Ninja

With more than 15 years of experience, Loveneet Singh is a seasoned digital marketing director, NLP entity SEO specialist, and data scientist. With a passion for all things Google, WordPress, SEO services, web development, and digital marketing, he brings a wealth of knowledge and expertise to every project. Loveneet’s commitment to creating people-first content that aligns with Google’s guidelines ensures that his articles provide a satisfying experience for readers. Stay updated with his insights and strategies to boost your online presence.